BY KISSA SMITH | LIFE SO ABUNDANT® | LIFESOABUNDANT.COM

Not enough money? Pay attention, because this is the hard truth that you might not want to hear: no one is coming to save you.

If you’re stressed about your lack of money, if bill collectors are harassing you, and if you’re living a lifestyle that’s less than desirable because of your lack of sufficient funds, then it’s time to face the reality that your financial independence or lack thereof is and will always be your responsibility.

You’re stuck in a financial rut that you don’t know how to get out of, but the only way to change that is to put your cape on and save yourself.

In today’s world, the financial situation is more uncertain than ever. Layoffs, businesses closing left and right, and the looming threat of a recession have left many people worried about the state of the economy. Interest rates are going up, discretionary income is going down, and inflation is a constant threat. But despite all of this, you still have control over your life. It’s time to take back the reins and take action to protect yourself.

The first step towards financial freedom is to fully accept responsibility for your current situation.

Assuming financial responsibility is crucial.

This might be a tough pill to swallow, but it’s the truth. If you ever want to turn your finances around, then you need to take responsibility for them. It’s time to take control of your life and your finances. Don’t wait for someone else to come and rescue you. The power to change your life is in your hands.

In this article, we’re going to explore some powerful, actionable steps that will help you build the life you desire.

No more feeling stuck in a financial rut or worrying about bill collectors harassing you. It’s time to take control of your life and your finances.

We understand that it can feel overwhelming at times, but we’re here to empower and support you.

These proven tips and advice will guide you through the process of creating financial independence and building the life you truly want.

So get ready to discover the steps you need to take to protect yourself and your finances in today’s uncertain world.

By fully accepting responsibility for your financial situation, you’ll be able to take control of your life and start making positive changes today. So, let’s dive in and explore the actionable steps you can take to turn your finances around and create the life you desire.

Identify the Root Cause

If you’re struggling with money worries, it’s important to identify the root cause. Common root causes include overspending, living beyond one’s means, and a lack of budgeting and financial planning.

Other factors may include high levels of debt, such as credit card or student loan debt, job loss or reduction in income, lack of financial education or knowledge, impulsive or emotional spending, lack of emergency savings, medical expenses or unexpected bills, underemployment or unemployment, poor investment decisions, ignoring financial problems and not seeking help, family or friends who rely on financial support, lack of income growth or salary stagnation, excessive use of loans and credit, and poor money management skills or habits.

It’s crucial to understand the root cause of your financial problems before making any changes. This will help you to create a more effective plan to improve your financial situation.

For example, if your root cause is overspending, then you may need to create a budget and stick to it to avoid unnecessary expenses.

If your root cause is lack of financial education or knowledge, then you may need to educate yourself on personal finance and seek out resources to help you better understand money management.

Whatever your root cause may be, identifying it will allow you to make targeted changes that will have a greater impact on your financial situation.

Remember, understanding the root cause is a fundamental step towards financial freedom.

Beyond Comfort: What Sacrifices Are You Willing to Make?

It’s time to ask yourself the tough question: “Why haven’t I taken action to improve my finances?”

Don’t shy away from the answer; be brutally honest.

Is it because you’ve been complacent, lacking motivation, or simply afraid to step out of your comfort zone?

Whatever the reason, face it head-on and acknowledge the role you’ve played in your current situation.

Once you’ve mustered the courage to face the truth, it’s time to evaluate your level of commitment.

How serious are you about changing your financial habits?

Are you truly willing to make the necessary sacrifices to turn things around?

It’s not enough to merely wish for a better financial future; you must be ready to take bold action.

That might mean cutting back on unnecessary expenses, giving up certain luxuries, or even taking on additional work to increase your income.

It won’t be easy, but remember that the road to financial success requires determination and unwavering dedication.

So, ask yourself again: What are you truly willing to sacrifice to make it happen?

Create a Budget

Create a budget that works for you.

A budget is not a suggestion; it’s a necessity.

It’s a powerful tool that will bring clarity and discipline to your financial life. Don’t underestimate its importance.

With a budget in place, you’ll be able to track your income and expenses, identify areas where you can cut back, and allocate your money wisely.

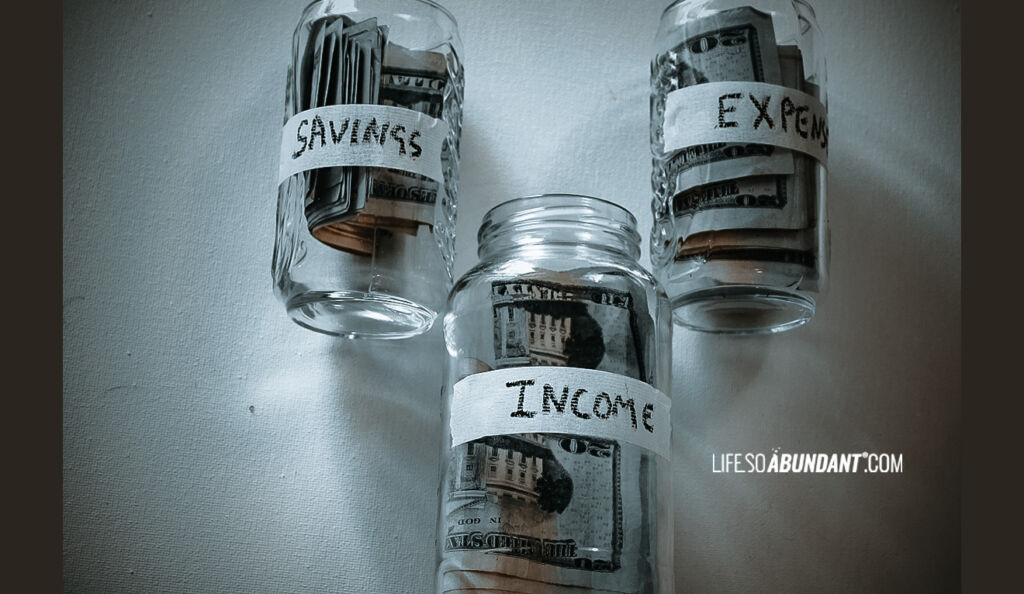

There are different methods you can use to create a budget, but two popular ones are zero-based budgeting and the envelope method.

Zero-based budgeting requires you to assign every dollar of your income a specific purpose, like saving funds and diminishing debt leaving no room for idle spending.

On the other hand, the envelope method involves dividing your cash into different envelopes labeled for different expenses, ensuring that you only spend what you have allocated for each category.

Now, creating a budget is one thing, but sticking to it is where the real challenge lies.

Here are some tips to help you stay on track:

First, set realistic goals and be disciplined in following your budget.

Second, track your expenses diligently and review your budget regularly to make adjustments if needed.

Third, avoid temptations and unnecessary expenses by identifying your priorities and focusing on what truly matters.

And finally, seek support and accountability from family, friends, or financial communities that can help keep you motivated and on the right track.

Remember, a budget is your roadmap to financial freedom, so take the reins and make it work for you.

Cut Back On Expenses

Here are some straightforward tips that will help you take control of your expenses and save more money.

First, identify those unnecessary expenses that are draining your wallet.

Take a hard look at your spending habits and distinguish between wants and needs.

Be honest with yourself and eliminate or reduce discretionary expenses that don’t align with your financial goals.

Skip that daily gourmet coffee, cancel unused subscriptions, and resist the urge to splurge on impulse purchases. Remember, every dollar you save counts.

Now, it’s time to get creative and find innovative ways to save money.

Look for practical solutions that don’t sacrifice your quality of life.

For example, consider meal planning and cooking at home instead of eating out.

Embrace DIY projects to avoid pricey services.

Shop smart by comparing prices, using coupons, and taking advantage of sales.

Explore free or low-cost entertainment options such as local community events or outdoor activities.

With a little resourcefulness and a commitment to your financial well-being, you’ll be amazed at how much you can save.

So, roll up your sleeves, be assertive, and start slashing those expenses. Your bank account will thank you.

Increase Your Income

Don’t settle for mediocrity; seize opportunities to earn more money and secure your financial future. Here are some assertive tips to help you boost your income and create a solid foundation for financial success.

Firstly, consider exploring different avenues to increase your earnings.

Think outside the box and be proactive.

Start a business that aligns with your skills and passions.

Don’t be afraid to take calculated risks and invest in yourself.

Additionally, it’s essential to advocate for your worth in your current job.

Ask for a well-deserved raise, demonstrate your value, and prove that you’re indispensable.

If necessary, consider pursuing a higher-paying job that matches your qualifications and experience.

Don’t settle for less when you have the potential to earn more.

Furthermore, don’t rely on a single source of income.

Diversify your income streams to safeguard yourself against financial instability.

Look for opportunities to create multiple streams of income, whether it’s through investments, freelancing, or generating passive income.

Explore side gigs or part-time work that can supplement your main income.

Be resourceful and tap into your skills and talents to generate additional money-making ideas.

Remember, the key is to be proactive, confident, and willing to put in the effort to achieve financial increase.

Don’t wait for opportunities to come to you; go out and seize them.

🚀 Make your dreams of entrepreneurship a reality! 💼💪 Start one of these 21 booming online businesses and unlock financial independence, razor-sharp focus, and a life of abundance. 🔓🌟 THRIVE NO MATTER WHAT. Join Our FREE 3-Day Challenge now! 💥 and begin your exciting adventure towards a flourishing future.

Pay Off Debt

Paying off debt should be a top priority if you want to achieve financial freedom.

Don’t let debt hold you back any longer. Take control and with conviction tackle your outstanding balances. Understand the significance of becoming debt-free and embrace the following strategies to make it happen.

First and foremost, recognize the importance of paying off debt. Debt not only weighs you down financially, but it also hampers your ability to build wealth and live the life you desire.

Free yourself from the burden of interest payments and the stress that comes with owing money.

Choose a method that works for you, whether it’s the snowball method or the avalanche method.

The snowball method involves tackling your smallest debts first and gaining momentum as you eliminate each one.

On the other hand, the avalanche method focuses on paying off debts with the highest interest rates first to minimize the overall interest paid.

Whichever method you choose, commit to it wholeheartedly and stay consistent.

As you embark on your debt repayment journey, staying motivated is crucial.

Remember why you started and visualize the freedom you’ll experience once you’re debt-free.

Track your progress and celebrate every milestone along the way.

Stay disciplined by creating a budget that prioritizes debt repayment.

Consider seeking support from family, friends, or online communities to stay motivated and accountable.

Avoid unnecessary temptations and make sacrifices when needed.

The road to debt freedom requires determination and perseverance, but with an unyielding mindset and unwavering focus, you can conquer your debts and achieve financial liberation.

Build an Emergency Fund

Building an emergency fund is not something to be shrugged off – it’s a necessity.

Stop living on the edge and take charge of your financial security.

An emergency fund serves as a safety net, providing you with the confidence and peace of mind to navigate unexpected expenses or financial setbacks. So, let’s get down to business and establish that essential buffer.

First and foremost, understand the importance of having an emergency fund.

Life is full of surprises, and it’s crucial to be prepared for them.

Whether it’s a sudden medical expense, a major car repair, or a job loss, having a financial cushion will prevent you from falling into debt or being caught off guard.

Treat your emergency fund as a non-negotiable priority, as essential as paying bills or putting food on the table.

To build your emergency fund, follow these solid tips.

Start by setting a specific savings goal – aim to accumulate at least three to six months’ worth of living expenses.

Be disciplined in saving a set amount each month and automate your savings if possible.

Trim unnecessary expenses and redirect that money towards your emergency fund.

Consider additional income streams or side gigs to accelerate your savings.

Stay focused and avoid dipping into the fund for non-emergency purposes.

Remember, an emergency fund is your financial shield, and building it requires determination, commitment, and a no-nonsense approach.

Invest for the Future

Investing for the future is not a luxury reserved for the wealthy – it’s a smart and bold move that everyone should make.

Break free from the limitations of a paycheck-to-paycheck lifestyle and secure your financial future. Understand the significance of investing and take decisive steps to grow your wealth.

Investing is the key to long-term financial success.

It allows your money to work for you, generating returns and building wealth over time.

Don’t settle for meager savings accounts with minimal interest rates.

Explore different investment options such as stocks, bonds, real estate, and precious metals like gold and silver.

Each investment avenue carries its own risks and rewards, so do your due diligence and seek professional advice if needed.

Remember, investing is a powerful tool that accelerates your journey to financial independence.

To get started with investing, adopt an assured mindset and follow these tips.

Educate yourself about the basics of investing and understand the potential risks involved.

Set clear investment goals that align with your financial aspirations.

Create a well-diversified portfolio to minimize risk and maximize potential returns.

Start small if you need to, but start now.

Don’t let fear or indecision hold you back.

Take action and open an investment account.

Regularly contribute to your investments, and resist the urge to make impulsive decisions based on short-term market fluctuations.

With a focused and confident approach, you can begin building a robust investment portfolio that will secure your financial future.

Avoid Common Financial Mistakes

Let’s address these common financial mistakes head-on and equip you with practical tips to steer clear of them.

Overspending and living beyond your means can lead to a vicious cycle of accumulating debt.

Break free from the consumer-driven culture and prioritize responsible spending.

Create a budget, track your expenses meticulously, and make sure your income exceeds your outgoings.

Embrace the power of saving by setting aside money for emergencies and retirement.

Neglecting these savings can leave you vulnerable to unexpected expenses or a future without financial security.

Be resolute in saving consistently and make it a non-negotiable part of your financial plan.

Another common mistake is mishandling credit card debt. Avoid the temptation to spend beyond your means and use credit cards responsibly.

Pay off your balance in full each month to avoid high interest charges.

Don’t be impulsive with your purchases, think about the long-term consequences and prioritize your financial goals.

Recognize the importance of insurance coverage and tax obligations to safeguard your financial well-being.

Finally, learn from past mistakes.

Reflect on your financial history, identify areas for improvement, and take proactive steps to enhance your financial literacy.

With a confident and determined mindset, you can navigate the financial landscape and build a solid foundation for a prosperous future.

Seek Professional Help if Necessary

When it comes to your financial well-being, don’t hesitate to seek professional help if necessary.

Be forward in taking action and tap into the expertise of financial advisors and credit counselors who can guide you towards financial success.

Let’s discuss the benefits of seeking professional help and how to find reputable individuals to assist you on your journey.

Financial advisors and credit counselors bring specialized knowledge and experience to the table.

They can provide valuable insights, personalized strategies, and objective advice tailored to your specific financial situation.

From investment guidance to debt management, these professionals have the tools to help you make informed decisions and navigate complex financial matters.

Don’t underestimate the impact they can have on your financial trajectory.

However, be proactive in researching and selecting the right professionals.

Look for reputable individuals with relevant qualifications, certifications, and a track record of success.

Seek recommendations from trusted sources, read reviews, and interview potential candidates to ensure they align with your goals and values.

Remember, your financial future is at stake, so take the time to do thorough research and find professionals who will have your best interests at heart.

With purpose and a commitment to finding the right help, you’ll be well on your way to achieving financial success.

Monitor Your Progress

Monitoring your progress is a vital aspect of achieving financial success.

Be persistent in tracking your progress to stay on top of your goals and maintain momentum.

Let’s explore the importance of monitoring progress and different ways to do so, ensuring you have the confidence and motivation to stay unwavering on your financial journey.

Tracking progress is crucial because it allows you to see how far you’ve come and identify areas that need improvement.

By keeping track of your finances, whether through budgeting apps or spreadsheets, you gain valuable insights into your spending habits, savings growth, and debt reduction.

It’s the only way to measure your progress accurately and make informed decisions for continued financial improvement.

Don’t underestimate the power of celebrating milestones along the way.

Acknowledging your achievements, no matter how small, as it fuels motivation and keeps you focused on your goals.

Take pride in every debt paid off, savings milestone reached, or budget successfully adhered to.

These celebrations serve as reminders of your determination and progress, bolstering your confidence to push forward.

Stay committed, stay motivated, and stay focused by diligently tracking your progress.

Keep records of your financial journey, review them regularly, and adjust your strategies as needed.

Remember, you can’t improve what you don’t measure.

So be dedicated, take charge of your financial progress, and let the numbers boost your confidence as you confidently march towards financial success.

Take Care of Yourself - You Got This!

Taking care of yourself is crucial, especially when dealing with financial stress.

Be adamant in prioritizing your well-being as you navigate through challenging times.

Let’s delve into the impact of financial stress on mental health, along with valuable tips for managing stress and embracing self-care.

Financial stress can significantly impact your mental well-being.

It can lead to anxiety, depression, and feelings of overwhelm.

Recognize the toll it can take on your overall health and be committed in addressing it head-on.

Manage stress by adopting healthy coping mechanisms such as exercise, meditation, and engaging in activities you enjoy.

Take time for self-care and prioritize activities that recharge and rejuvenate you.

Remember, you are not alone in this journey, and seeking support from friends, family, or professional counselors can provide valuable guidance and emotional reassurance.

Maintaining balance is essential.

Celebrate your progress, no matter how small, and be kind to yourself throughout the process.

Embrace patience and understand that achieving financial stability takes time.

Don’t underestimate the power of the present moment.

Live in it, savor your progress, and acknowledge your determination to move forward.

Believe in yourself, trust that you have what it takes to overcome financial challenges, and remain confident in your ability to succeed.

Keep going, stay resilient, and never give up.

You have the strength within you to create a brighter financial future.